My Insight Hub

Your go-to source for daily insights and updates.

Insurance That Won't Break the Bank for Small Biz Heroes

Discover affordable insurance solutions that empower small biz heroes to thrive without breaking the bank! Save money and protect your passion today!

Top 5 Affordable Insurance Options for Small Businesses

Running a small business comes with its unique set of challenges, one of which is finding the right insurance coverage. With numerous options available, it can be overwhelming to narrow down the affordable insurance options for small businesses. Here are the top five choices that offer both coverage and cost-effectiveness:

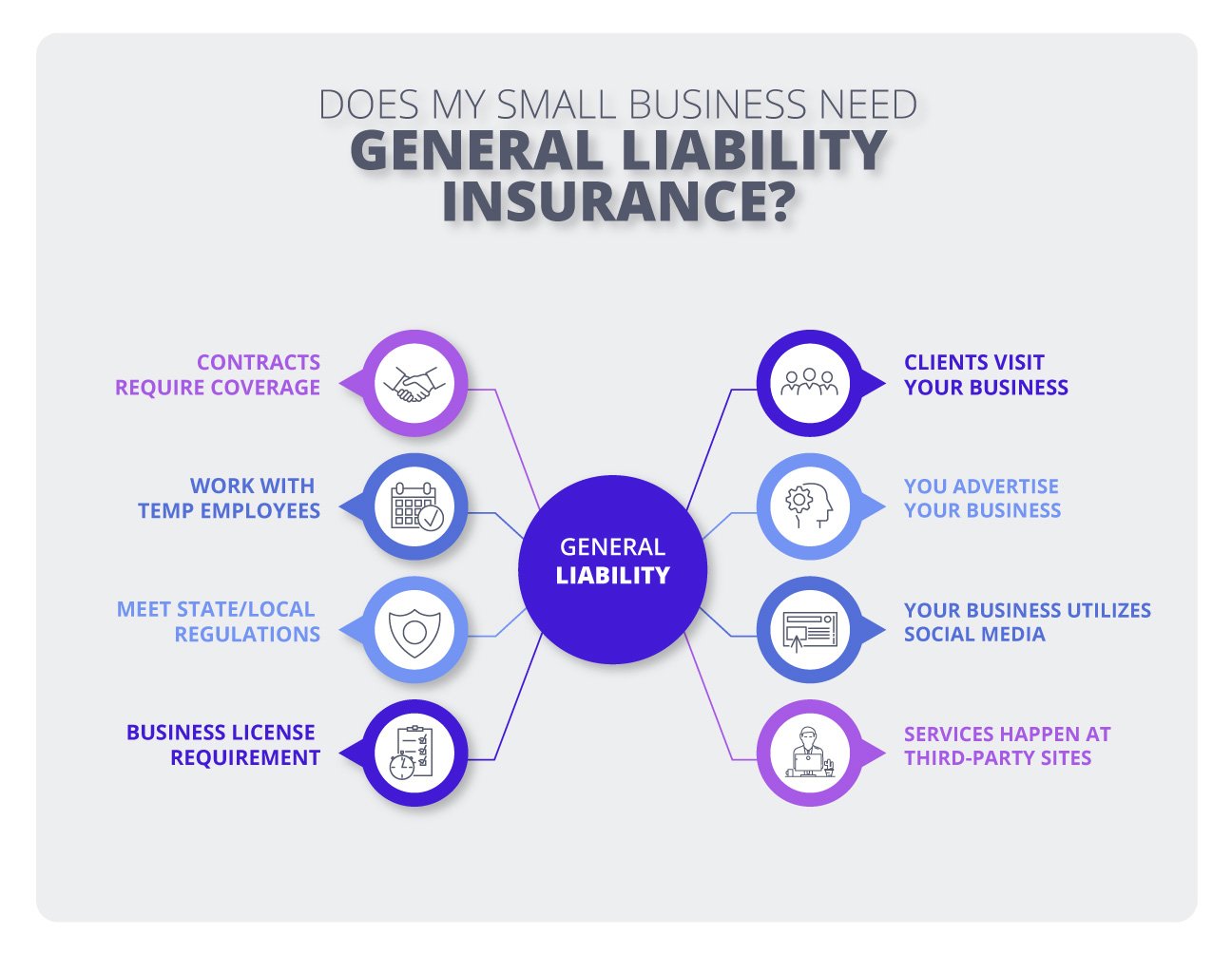

- General Liability Insurance: This is a must-have for small businesses, protecting against bodily injury and property damage claims. It is often considered one of the most affordable and essential types of insurance. For more information on general liability insurance, visit SBA.

- Professional Liability Insurance: Also known as Errors and Omissions Insurance, this coverage is particularly important for service-based businesses. It protects against claims of negligence or failure to deliver services. For a breakdown of professional liability insurance, refer to Insureon.

- Property Insurance: If your business owns property, this insurance helps cover damage to your building and its contents. It's a crucial safety net, especially for retail and manufacturing businesses. See more about property insurance at Nolo.

- Workers' Compensation Insurance: Even if your business is small, if you have employees, this insurance is often required by law. It provides wage replacement and medical benefits to employees injured on the job. Detailed information can be found at Business News Daily.

- Business Interruption Insurance: This type of insurance covers lost income during unexpected disruptions, making it a wise investment for small businesses in uncertain times. To learn more about how it can help your business, check out The Balance SMB.

How to Choose Insurance That Fits Your Small Business Budget

Choosing the right insurance for your small business is crucial, as it protects your assets and provides peace of mind. Start by assessing your specific needs based on factors such as industry type, the size of your business, and potential risks. Consider the various types of insurance available, including general liability, property, and workers' compensation. Resources like the SBA can provide valuable insights on mandatory insurance requirements tailored to your state and industry.

Once you have a clear understanding of your insurance needs, it’s time to evaluate your budget. Identify how much you can comfortably allocate toward insurance premiums without sacrificing essential business expenses. To ensure you get the best coverage for your investment, compare quotes from multiple providers. Websites like Insureon and Policygenius allow you to easily compare rates and comprehensively understand your options, helping you make an informed decision that won’t stretch your financial resources.

Common Insurance Myths Small Biz Owners Should Know

Common insurance myths can lead small business owners to make uninformed decisions that ultimately impact their financial stability. One prevalent myth is that all business insurance is the same. Many entrepreneurs believe that if they have one type of insurance, such as liability coverage, they are fully protected. However, insurance needs vary significantly depending on the nature of the business, its location, and its specific risks. It's crucial for business owners to understand the different types of insurance available, such as property, workers' compensation, and professional liability, to ensure comprehensive coverage.

Another misconception is that small businesses are not at risk for lawsuits or claims. This is far from the truth; small businesses are often targets for lawsuits due to their limited resources and visibility. Additionally, many small business owners underestimate the financial impact a single lawsuit can have on their operations. By acknowledging the risks and investing in the appropriate coverage, business owners can safeguard their assets and ensure long-term sustainability.