My Insight Hub

Your go-to source for daily insights and updates.

Cheap Insurance Hacks That Could Save You a Fortune

Discover clever insurance hacks to slash your costs and save big! Unlock secrets that could save you a fortune today!

10 Little-Known Tips to Slash Your Insurance Premiums

Reducing your insurance premiums can be easier than you think. Here are 10 little-known tips that can help you save money:

- Bundle Your Policies: Consider bundling your auto and home insurance with the same provider. Companies often offer significant discounts to customers who combine their policies. For more insights, check out this guide.

- Increase Your Deductible: Raising your deductible can lead to lower monthly premiums. Just ensure you have enough savings to cover the increased deductible amount in case of a claim. For more information on how this works, visit this article.

Furthermore, always stay proactive about your coverage. Here's more to consider:

- Shop Around Regularly: Don’t settle for the first offer. Regularly compare quotes from different insurers to ensure you're getting the best rate. Resources like ValuePenguin can help simplify this process.

- Take Advantage of Discounts: Many insurers offer discounts for various reasons such as good driving records, being a member of certain organizations, or even for completing a defensive driving course. It's worth asking your provider about available discounts or checking sites like AutoInsurance.org.

How to Compare Insurance Policies Like a Pro and Save Big

Comparing insurance policies can seem daunting, but with the right approach, you can compare insurance policies like a pro. Start by gathering quotes from multiple providers, ensuring that you look at similar coverage levels. Websites like Policygenius and Insurance.com allow you to input your information and receive side-by-side comparisons, making it easier to spot the best deals. Consider not just the premium costs but also deductibles, coverage limits, and any exclusions that might affect your final decision.

Once you've narrowed down your options, it's vital to read through the policy details carefully. Look for customer reviews on sites like ZDNet to gauge the experiences of others with specific insurers. Pay attention to the claims process—a quicker, more efficient process can save you time and hassle in the future. By following these steps, you can confidently compare insurance policies and secure the coverage you need while keeping your budget intact.

Are You Overpaying for Insurance? Common Mistakes to Avoid

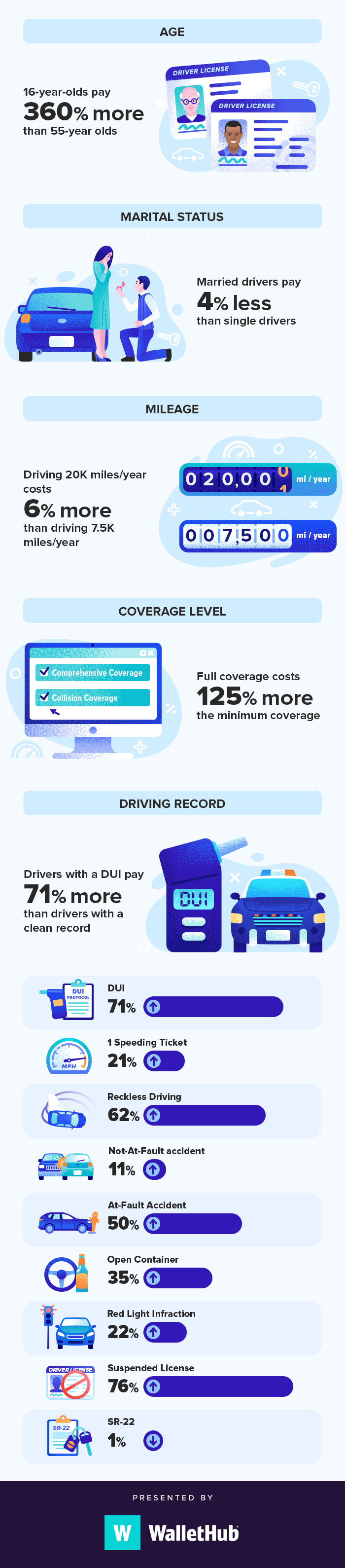

Insurance is a necessary expense for many people, yet it’s common to overpay for coverage due to a lack of understanding or mismanagement of policies. One prevalent mistake is failing to shop around for quotes from multiple providers. By comparing different rates and coverage options, you can identify opportunities to save significantly. Additionally, many individuals overlook the importance of reviewing their policies regularly, which can lead to paying for unnecessary coverage or being unaware of discounts that could apply based on changes in life circumstances, such as marriage or having a child.

Another common pitfall is not taking advantage of bundling discounts. Many insurance companies offer substantial savings when you combine different types of insurance, such as home and auto. This can be a critical way to reduce your overall premium costs. Furthermore, be cautious about over-insuring your assets. Ensure that you have the right amount of coverage without redundant policies, such as overlap in auto insurance and roadside assistance plans. By being proactive and informed, you can avoid the mistake of overpaying and find a plan that genuinely meets your needs.