My Insight Hub

Your go-to source for daily insights and updates.

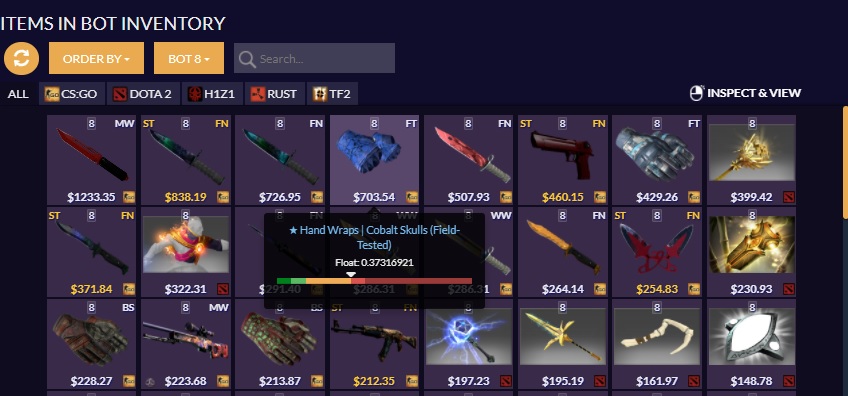

CS2 Trade Bots: Your New Best Friends in Virtual Currency Exchange

Unlock profit potential with CS2 Trade Bots! Discover how these powerful tools can revolutionize your virtual currency trading today!

Understanding CS2 Trade Bots: How They Revolutionize Virtual Currency Exchange

In the rapidly evolving world of digital transactions, CS2 trade bots have emerged as a game-changing innovation for virtual currency exchange. These sophisticated algorithms leverage artificial intelligence to analyze market trends, automate trades, and execute transactions with minimal human intervention. By utilizing a vast amount of historical data, CS2 trade bots can make informed decisions, enabling traders to capitalize on price fluctuations and optimize their trading strategies effectively. This advancement not only enhances the trading experience but also significantly reduces the risk associated with traditional trading methods.

Moreover, the integration of CS2 trade bots into virtual currency exchanges streamlines the trading process and increases efficiency. Users can customize their trading parameters, allowing the bots to execute trades 24/7 based on predefined market conditions. This automation results in faster transaction times and greater liquidity within the market. Additionally, as more traders adopt these bots, the overall reliability of virtual currency exchanges improves, fostering a more robust trading environment. Ultimately, the rise of CS2 trade bots represents a significant leap forward in the way individuals and institutions engage with digital currencies.

Counter-Strike is a popular first-person shooter game that has captivated players around the world with its competitive gameplay and strategic depth. One of the exciting additions to the game is the Operation Riptide Case, which brings new skins and content for players to enjoy.

Maximizing Your Profits: A Guide to Using CS2 Trade Bots Effectively

In the fast-paced world of CS2 trading, leveraging trade bots effectively can be the key to maximizing your profits. These automated tools allow traders to execute multiple trades simultaneously, ensuring that they don't miss out on lucrative opportunities. To get started, it's essential to select a reliable CS2 trade bot that aligns with your trading strategy and risk tolerance. Once you’ve chosen your bot, spend time configuring its settings to suit market trends and your personal trading style. This involves determining the right parameters for buy and sell signals, and understanding the bot's algorithms to make informed decisions.

Moreover, regular monitoring of your bot's performance is crucial. Even the best CS2 trade bots require oversight to ensure optimal functioning and profitability. Set up a schedule to review the bot's trading history, assess whether it meets your profit expectations, and adjust its settings as necessary. For those serious about maximizing their profits, diving deeper into learning about market analysis and the AI behind these bots can offer an added edge. Engage with the community through forums and social media groups to share insights and strategies. Remember, the goal is not just to automate trading but to maximize your profits effectively!

Are CS2 Trade Bots the Future of Currency Trading? Exploring the Benefits and Risks

As the digital finance landscape continues to evolve, CS2 trade bots are emerging as a potential game changer in the realm of currency trading. These automated systems leverage complex algorithms to analyze market trends and execute trades at lightning speed, minimizing the emotional biases that often impede human traders. One of the primary benefits of using CS2 trade bots is their ability to operate 24/7, allowing investors to capitalize on trading opportunities in real-time, even while they sleep. Additionally, they can process vast amounts of data far beyond human capacity, identifying patterns that could go unnoticed and assisting traders in making informed decisions.

However, the integration of CS2 trade bots into currency trading is not without its risks. One major concern is the potential for technical failures and bugs within the software, which could lead to significant financial losses. Furthermore, the reliance on algorithms may reduce a trader's understanding of the market, fostering dependency on automated systems and potentially eroding essential trading skills. As the use of these bots expands, it is crucial for traders to balance the advantages provided by automation with a robust understanding of market dynamics, ensuring they remain informed and prepared for the inherent risks associated with automated trading.