My Insight Hub

Your go-to source for daily insights and updates.

The Force Buy Revolution: Turning Pennies into Power Plays

Discover how small investments can create big wins in The Force Buy Revolution. Turn your pennies into powerful play today!

How to Identify Hidden Opportunities in the Force Buy Revolution

The Force Buy Revolution is reshaping the landscape of e-commerce and retail, creating a plethora of hidden opportunities for savvy entrepreneurs. To identify these opportunities, start by analyzing consumer behavior trends. Utilize tools like Google Trends and social media analytics to pinpoint emerging demands in specific niches. Look for gaps in the market where customer needs are not being fully met; this could be anything from bundling products that sell well together to offering customizable options that cater to individual preferences.

Another method to unearth hidden gems is by engaging with your audience through surveys or feedback forms. Ask your customers what they feel is missing from their shopping experience or what products they wish were available. By leveraging this insight, you can adapt your offerings to align with customer desires, effectively positioning yourself at the forefront of the Force Buy Revolution. Additionally, keep an eye on competitor offerings and reviews—there's often valuable information highlighting what consumers are looking for that you can capitalize on.

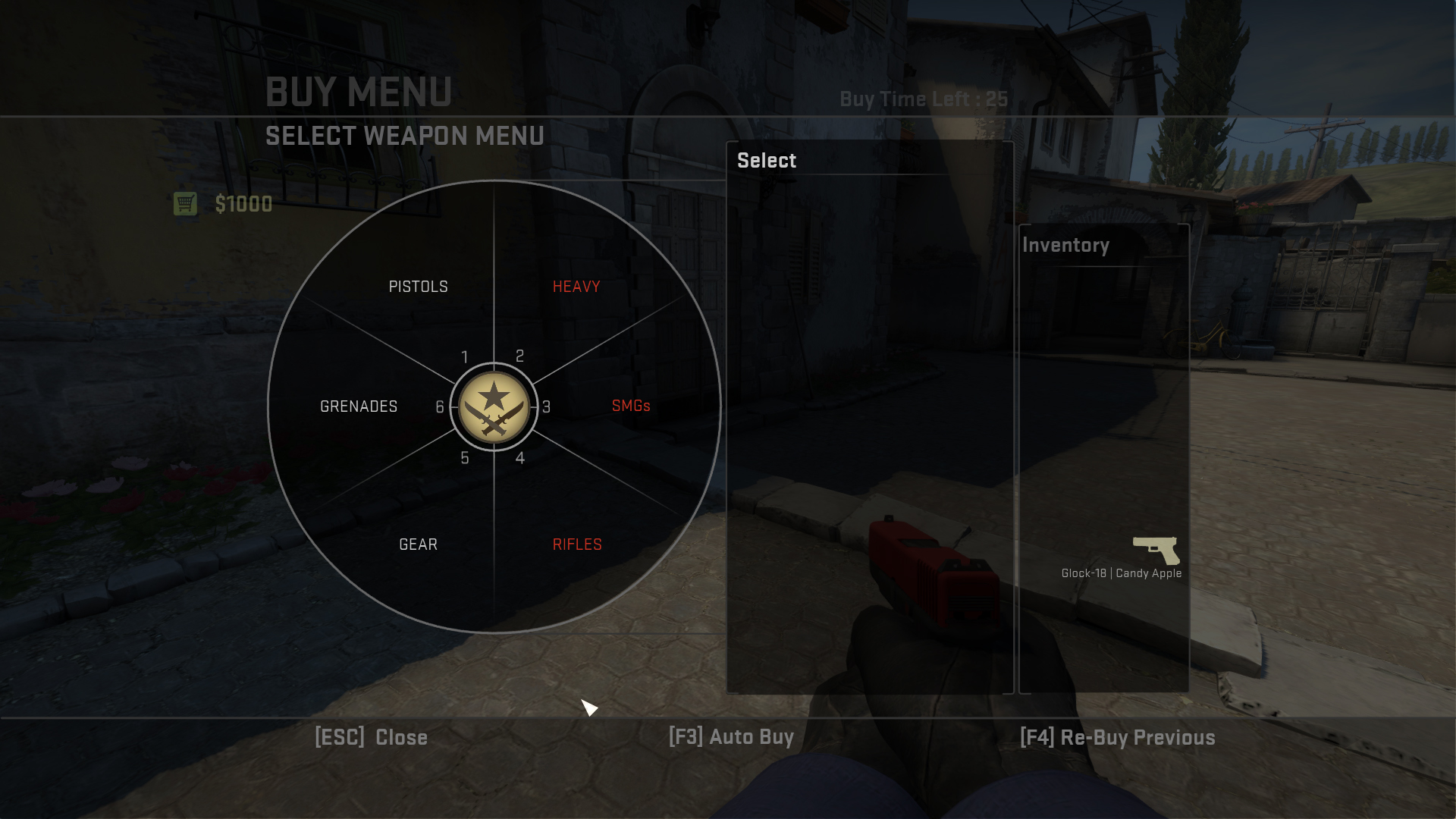

Counter-Strike is a highly popular team-based first-person shooter game known for its strategic gameplay and competitive scene. Players can engage in various game modes and utilize tools like the cs2 trade up calculator to enhance their gaming experience. The game's rich history and continuous updates keep the community engaged and excited.

Maximizing Returns: Strategies for Turning Small Investments into Big Wins

Investing can often seem daunting, especially when you're starting with a small amount of capital. However, maximizing returns isn't only about having a large sum to invest; it's about making smart choices that can lead to significant gains over time. One effective strategy is to diversify your investments across different asset classes such as stocks, bonds, and real estate. This not only spreads risk but also opens up multiple avenues for potential growth. Consider setting up a systematic investment plan (SIP) which allows you to invest a fixed amount regularly, helping you capitalize on market fluctuations and build a portfolio that thrives even with modest initial contributions.

Another strategy for turning small investments into big wins is to focus on high-growth opportunities. Research sectors that are trending upwards, such as technology or renewable energy, and consider micro-investing in companies within these industries. Utilizing platforms that allow fractional shares can also enable you to invest in high-value stocks without needing significant capital upfront. Furthermore, educate yourself continuously—attending workshops, reading investment literature, and following market trends will equip you with the knowledge necessary to make informed decisions. Remember, the key to reaping substantial returns is patience and informed strategic planning.

What You Need to Know About Leveraging Small Funds for Major Impact

Leveraging small funds for major impact is a powerful strategy that allows individuals and organizations to maximize their financial resources without needing substantial capital. Whether you’re a budding entrepreneur, a nonprofit organization, or an individual investor, understanding how to strategically allocate small funds can lead to significant returns. By focusing on impact investing, you can align your financial goals with social or environmental outcomes, ensuring that even modest amounts of money can contribute to meaningful change.

To effectively leverage small funds, consider the following strategies:

- Prioritize partnerships: Collaborating with other like-minded investors or organizations can amplify your impact.

- Invest in training: Building skills within the community can often yield larger long-term benefits.

- Embrace technology: Utilize digital platforms that allow for micro-investments or crowdfunding to reach a wider audience.

By being strategic and intentional with how small funds are utilized, you can create ripple effects that lead to substantial transformations.