My Insight Hub

Your go-to source for daily insights and updates.

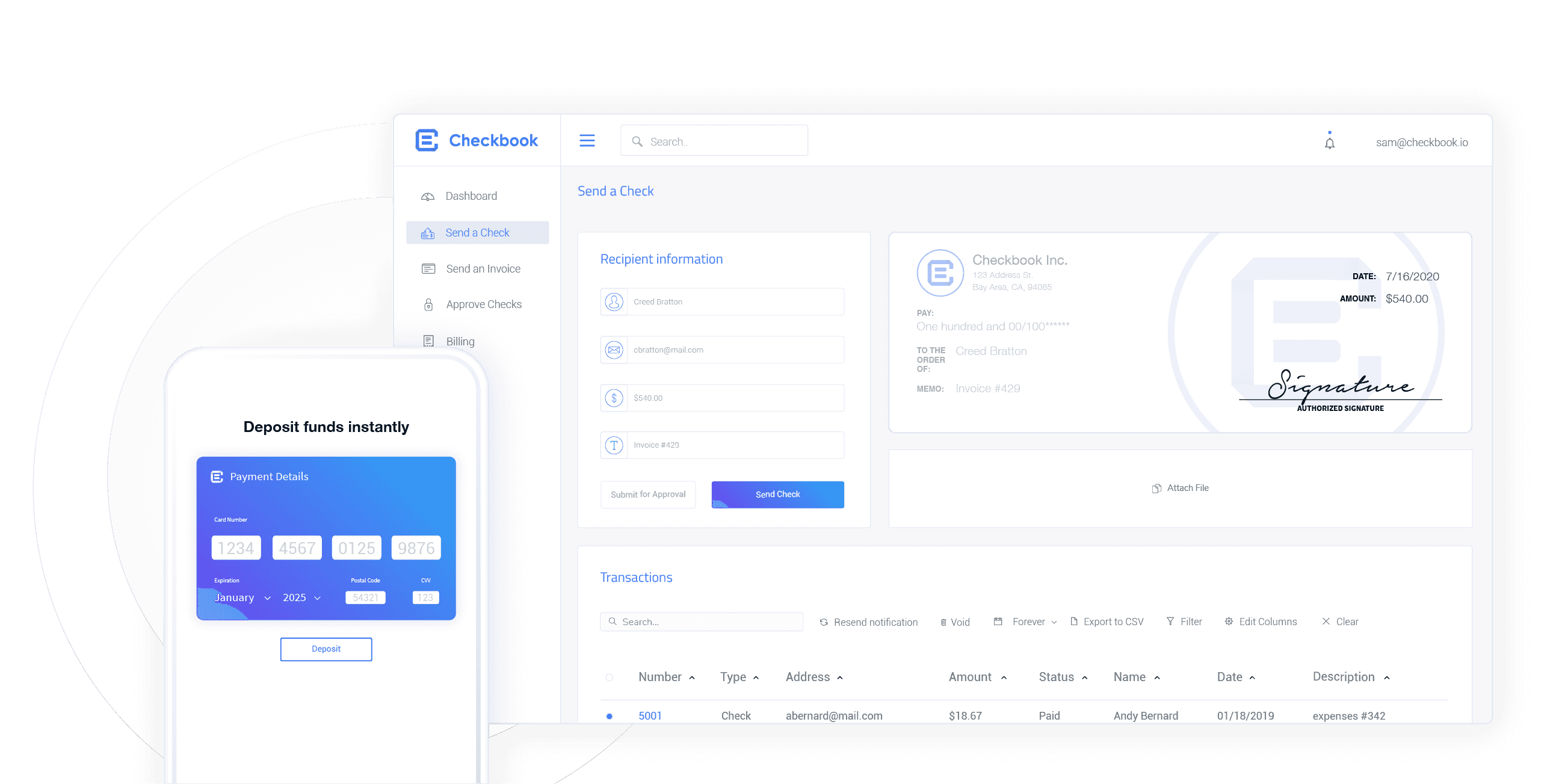

Instant Payout Systems: Where Your Wallet Gets a Fast Track Makeover

Revamp your finances with instant payout systems! Discover how to boost your wallet's potential and enjoy quick cash every time.

5 Instant Payout Systems That Will Transform Your Finances

In today's fast-paced digital economy, finding instant payout systems is crucial for anyone looking to optimize their financial management. With these revolutionary platforms, you can receive your earnings almost immediately, helping you to reinvest or cover expenses without delay. Below are five standout options that promise to transform your finances effectively:

- PayPal Instant Transfer: This popular platform allows users to transfer funds instantly to their linked bank accounts or debit cards with a minimal fee.

- Cash App: Known for its ease of use, Cash App enables instant transfers between users and offers a debit card for immediate access to your cash.

- Venmo: With its social media-like interface, Venmo makes instant payments between users seamless and fun.

- Square: Originally designed for merchants, Square now offers instant payouts for small businesses, ensuring they have quick access to their earnings.

- Zelle: This banking network allows for instant payments between different bank accounts, making it a direct and effective solution for quick transactions.

Counter-Strike is a highly competitive first-person shooter game that has garnered a massive following since its inception. Players engage in team-based gameplay, completing objectives such as bomb defusal or hostage rescue. For those looking to enhance their gaming experience, using a clash promo code can unlock various benefits and rewards.

How Instant Payouts Work: A Comprehensive Guide

In today's fast-paced digital economy, instant payouts have revolutionized the way we think about transactions and payment processing. But how exactly do they work? Essentially, instant payouts allow users to access their earnings almost immediately after a transaction is completed. This technology leverages sophisticated payment gateways and real-time data processing systems to ensure that funds are transferred quickly and securely. The primary players in this process are payment processors, financial institutions, and the platforms that facilitate these transactions, all working in harmony to deliver a seamless experience.

To understand the mechanics behind instant payouts, it’s helpful to consider the key components involved:

- Payment Gateway: This technology captures and processes payment information, making it the first step in enabling instant payouts.

- Clearing and Settlement: Traditionally, this process can take days; however, with instant payouts, it occurs in real-time, allowing for immediate access to funds.

- User Experience: Many platforms integrate this feature to enhance user satisfaction, making it easier for businesses and freelancers to manage their finances.

By utilizing these technologies, companies can offer their clients and employees the convenience of getting paid swiftly, fostering trust and loyalty in the long run.

Are Instant Payout Systems the Future of Payment Processing?

The rise of instant payout systems is reshaping the landscape of payment processing, offering businesses and consumers unprecedented access to funds. Traditional payment methods often involve waiting days or even weeks for transactions to clear, creating cash flow issues for many small businesses. With instant payout options, entrepreneurs can access their earnings in real-time, which can be crucial for managing expenses and reinvesting in their operations. This immediacy enhances liquidity and allows for greater flexibility, making instant payouts a worthy consideration for modern businesses.

Moreover, as the demand for instant payment solutions grows, financial technology companies are innovating to make these systems more accessible and secure. Features such as enhanced fraud protection and robust user verification processes have made instant payouts not only faster but also safer. As consumers increasingly expect rapid transactions and seamless payment experiences, adopting these systems could be key for businesses aiming to stay competitive in an ever-evolving marketplace. The future of payment processing may very well hinge on the widespread adoption of instant payout systems, fundamentally changing how we think about money transfer.